What is it?

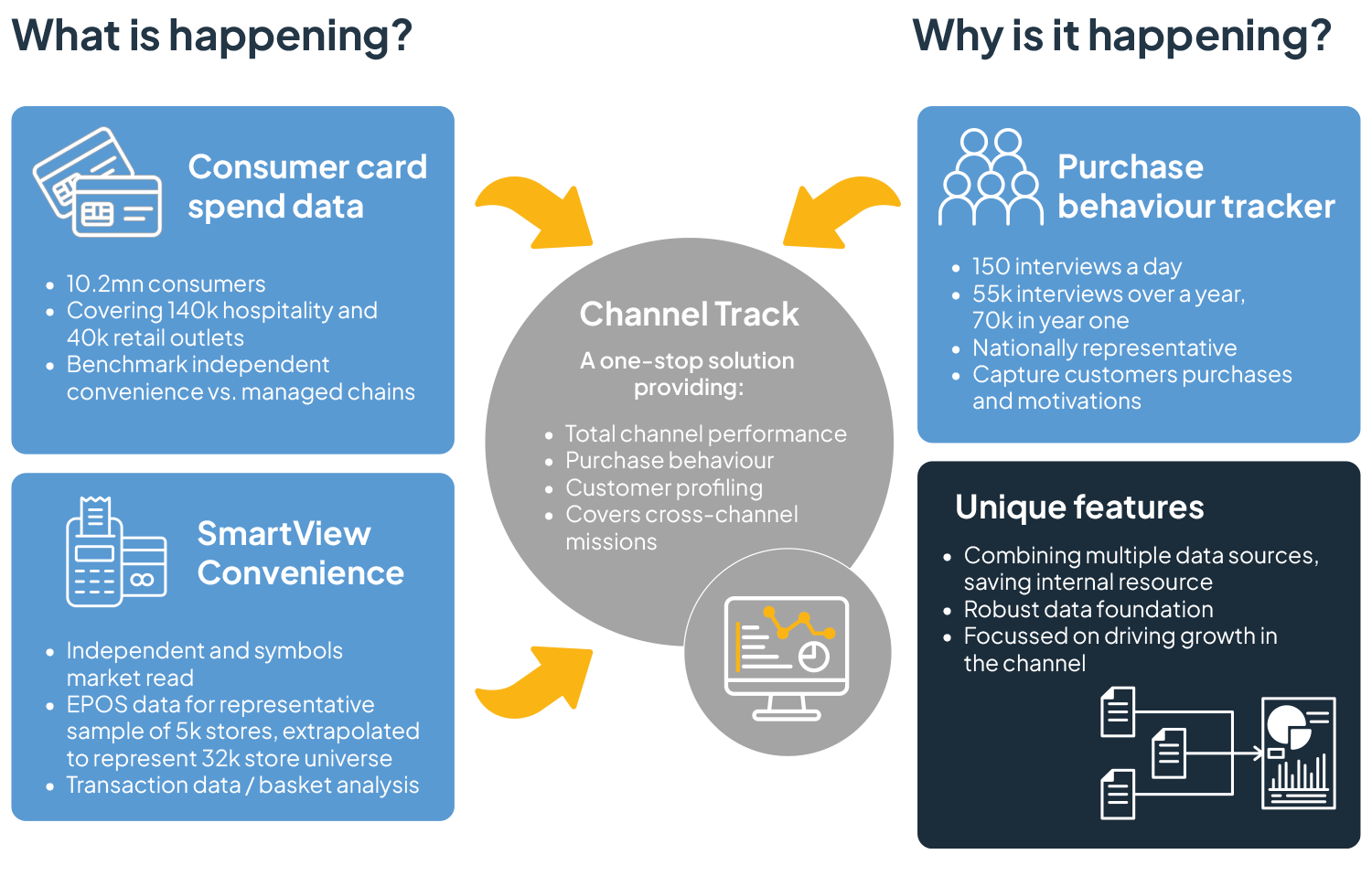

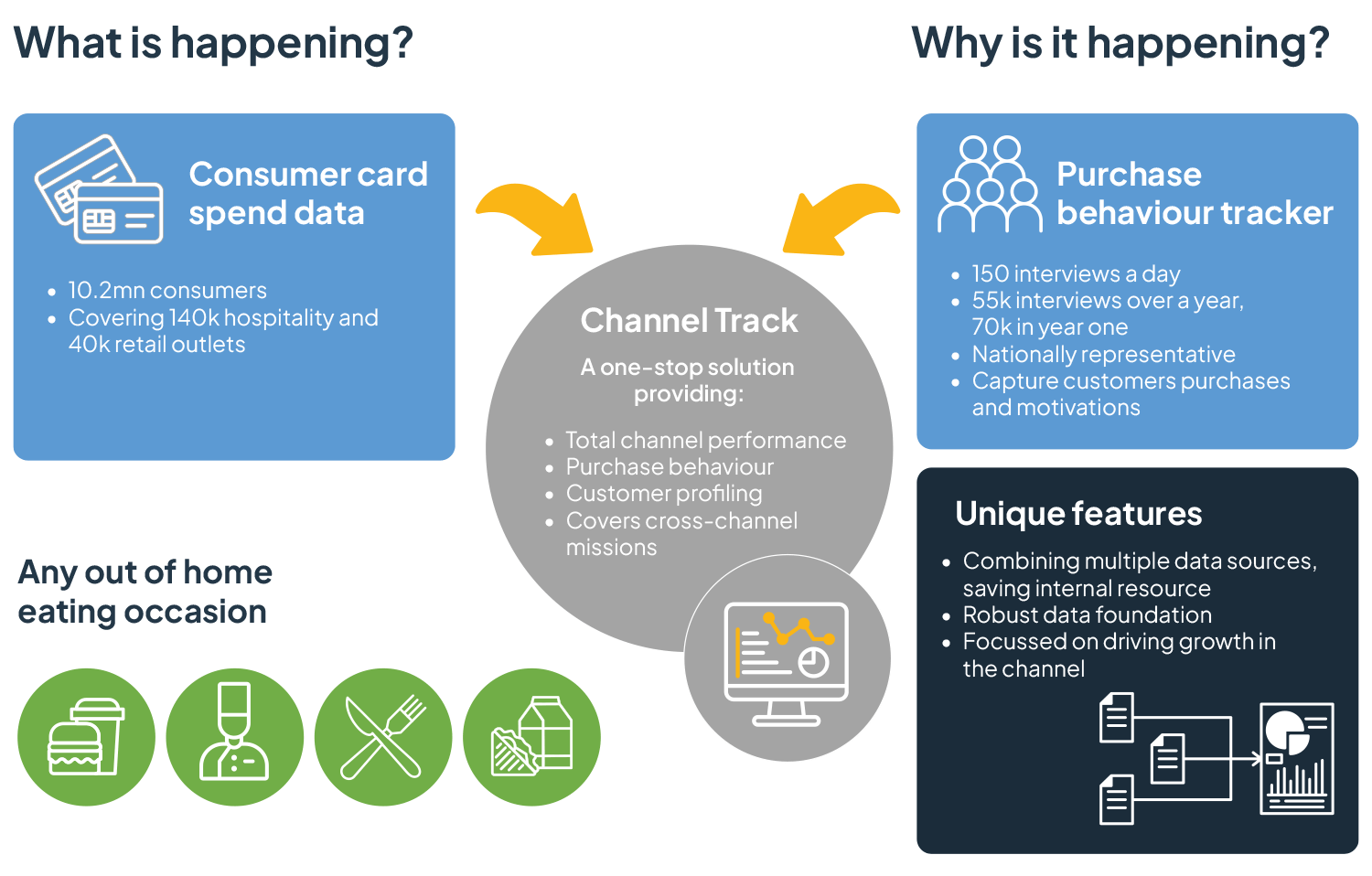

Channel Track is built on the strongest possible foundation: consumer spend.

We analyse debit and credit card transactions from 10.2 million consumers, covering 40,000 convenience stores and 145,000 foodservice outlets. Updated daily with only a 7-day lag, this banking data captures billions of transactions each year. Its scale and granularity mean we can track sales at every level – from total market trends to individual outlets, categories, regions, and even day-of-week patterns.

But we don’t stop at the “what.”

Our continuous shopper research elevates the data, adding the “why” behind the spend. By capturing real-life motivations, missions, and behaviours, Channel Track turns raw transaction data into insight – helping you not only see performance, but understand the drivers behind it and act on opportunities.

Channel Track (Convenience)

Delivering the most robust data and insight solution – focused on driving channel growth

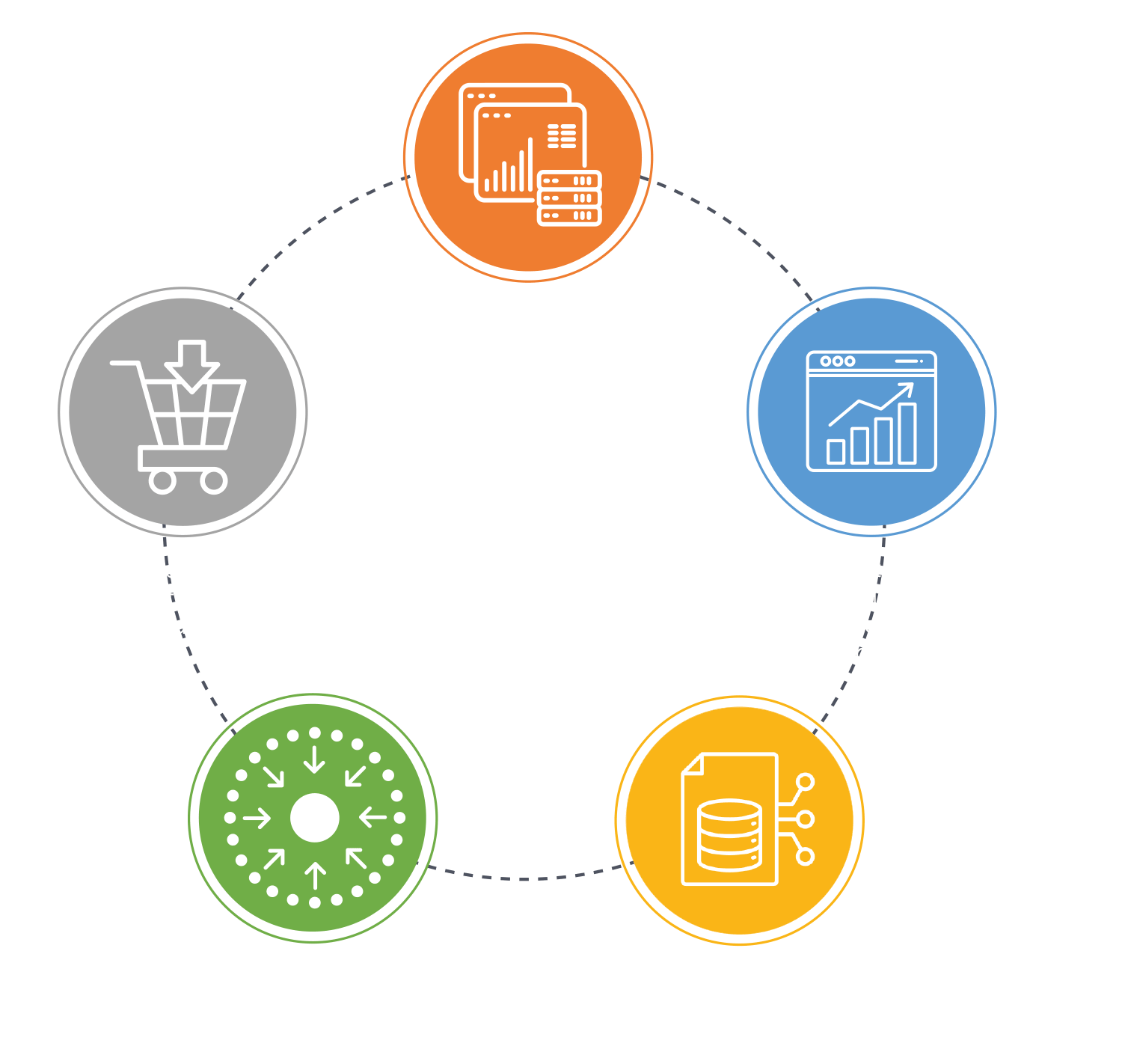

How does it work?

Channel Track’s foundations will be the spend data of 10.2 million consumers – on their debit and credit cards.

- Based on spend data from 10.2 million consumers, tracking 40,000 convenience stores and 145,000 foodservice outlets

- Updated daily with just a 7-day lag

- Provides insights at every level: outlet, outlet type, region, day of week, and more

- Independent c-stores, managed chains, discounters (Aldi, Lidl), supermarkets, and major mults’ c-stores (Tesco Express, Sainsbury’s Local, etc.)

- Foodservice split by independent outlets vs managed chains

- Includes online ordering and quick commerce

- Builds on TWC’s established SmartView Convenience (SVC) service, recognised as the most reflective market read for the independent convenience sector

- Combines banking data with continuous shopper research

- Daily consumer interviews (70,000 in Year 1) capturing:

Missions, purchases, and failed intentions (missed sales opportunities)

Impulse buys, consumption occasions, and outlet choice drivers

Retail & foodservice occasions (dine in / take out, who with, why chosen)

- Topical issues explored each quarter (e.g. PMPs, NPD, challenger brands, vaping, own label growth, healthier choices, meal deals)

- Topics agreed with subscribers

What are the Benefits?

The consumer spend data will tell us what is happening, when, where….by who (profiles, demographic detail), frequency, and catchment pull/where travelled from.

We will elevate this impressive data set with consumer/shopper research which will inform us what is being bought, why…and much more.

For example, in convenience retail, we will want to know what missions shoppers are on, what items they bought, whether they failed to buy items on their last visit (failed intentions = lost sales), whether impulse purchases were made, when and where products are going to be consumed, and by who (the shoppers is often not the consumer).

In foodservice, subscribers will want to know what occasions consumers are on, what they’re buying, who they’re with, whether it is for ‘dine in’ or ‘take out’, what influenced their outlet choice and purchase selection, and so on.

Performance

KPI Drivers

Demographics

Who is visiting (and not visiting) each sector / sub sector / chain (where appropriate)

Which demographic group is driving under/over performance?

Category / Product / Mission / Occasion

Where does each chain over/under perform.

Opportunities

What is the size of the prize?

Importances and Ratings

Strengths and weaknesses by fascia.

Point of purchase drivers

% purchased on impulse

% on a meal deal

How does each sector/sub sector/chain perform vs market?

Mission/outlet choice

Planned or impulse visit?

Alone or with others?

What need state drove to visit?

Will Channel Track cover total market?

Yes. While we want to support independent channels, the research will cover the total retail and foodservice channels.

In ‘convenience’, our read will cover independent c-stores as well as managed c-stores/chains, including the major mults’ c-stores (Tesco Express, Sainsbury’s Local, Morrisons Daily, Asda Express). But a lot of convenience missions (small basket ‘top up’ trips) occur in discounter stores (Aldi and Lidl) as well as in large format supermarket / superstores – so we will be including these outlets within our ‘total market coverage’.

In foodservice, we will be able to differentiate between managed chains and independent outlets.

Channel Track will also capture online ordering and quick commerce from retail and foodservice outlets. We will be able to report results as soon as minimum sample levels have been achieved.

When does it start?

- Data is live now (Aug 2025) → Book a demo today

- Consumer research starts September 2025

- First combined outputs available once sample sizes are robust

- 70,000 interviews Year 1 (150/day, with extra in first 3 months for quicker insights)

Channel Track (Hospitality)

Delivering the most robust data and insight solution – focused on driving channel growth

Summary of Channel Track Benefits: